The Ultimate Hedge for Asia in a Changing Monetary World

Gold has long been a cultural and economic cornerstone in Asia, revered for its stability and intrinsic value. From the bustling gold markets of Hong Kong to the strategic reserves amassed by central banks across the region, gold’s significance is undeniable. With prices still near-record highs, its allure for Hong Kong investors has never been stronger. Gold serves as a hedge against inflation, geopolitical uncertainty, and the shifting tides of global finance—a role it has played for centuries. This article explores why gold remains a vital asset, particularly as Asia, led by China, reshapes the monetary landscape, and why it stands as a reliable protector of wealth in an era of fiat currency volatility.

A Golden Surge with Asian Roots

Gold’s recent performance is nothing short of remarkable. On October 5, 2023, an ounce cost $1,830; today, it has surged 75% in just 18 months, outpacing global stock markets. Over the past 25 years, the picture is even more striking: gold has risen from $250 per ounce in 1999 to current levels—a 1,180% gain. This long-term upward trend echoes historical bull markets, such as the 2,185% rise from 1971 to 1980 and the 670% increase from 1999 to 2011. Despite bear markets in the 1980s and early 2010s, gold’s trajectory since the end of the gold standard in 1971—when prices were fixed at $35 per ounce—shows a staggering 9,000% increase, cementing its status as a relentless performer.

Asia’s influence is central to this surge. Hong Kong’s gold markets, anchored by the century-old Chinese Gold and Silver Exchange Society, are a global hub where traders and investors thrive. The city’s strategic location and deep ties to mainland China make it a focal point for gold trading, with physical gold often seen as a symbol of prosperity during festivals and economic downturns. Retail demand in China and Hong Kong has spiked, with gold bars and coins flying off shelves amid economic uncertainty. China’s central bank has added 1,181 metric tonnes (mt) to its reserves, reaching 2,235mt, as part of a broader strategy to diversify away from U.S. dollar assets. India, another key player, has also bolstered its holdings, reflecting a regional shift toward gold as a safe haven amid global volatility.

Drivers of Gold’s Ascent in Asia - Supply and Demand Dynamics

The fundamental driver of gold’s rise is the imbalance between supply and demand, a dynamic keenly felt in Asia. Global mining output has stagnated, dropping from 130 million ounces in 2018 to 120 million in 2024, with only modest growth projected through 2030. Rising production costs—particularly for energy and water—make new discoveries harder to exploit, keeping supply flat. Meanwhile, demand, especially from Asia, continues to grow. Central banks in developing markets, led by China, Russia, and India, have transitioned from net sellers to net buyers since 2010, increasing global reserves from 30,000mt to over 35,000mt today. This trend is particularly pronounced in Asia, where cultural affinity for gold as a store of value amplifies demand, especially during times of economic uncertainty.

China’s Gold Strategy and Currency Ambitions

China’s gold accumulation is part of a broader push to internationalize the yuan, challenging the U.S. dollar’s 58% share of global foreign exchange reserves (down from 72% in 2000). The yuan now accounts for 2.2% of reserves (up from 1.1% in 2016) and 4.7% of global payments, reflecting Beijing’s ambition to elevate its currency’s global role. Finance professor Yang Changjiang has called recent U.S. Treasury market volatility a “watershed event,” suggesting the yuan could emerge as a safe-haven asset—a bold aspiration given the dollar’s entrenched dominance. This shift is bolstered by the Cross-Border Interbank Payment System (CIPS), which processed $24 trillion in transactions in 2024—a 42% year-over-year increase. As China, the world’s top trading partner with over 120 countries, pushes yuan-based trade, gold serves as a critical backstop, providing a hedge against currency risks.

BRICS+ and the New Payment Frontier

The BRICS+ alliance, prominently featuring China and India, is developing a payment system to bypass Western networks like SWIFT, which has long been the backbone of international finance. Using proprietary cables, secure servers, and blockchain technology, this system settles trades in local currencies, reducing reliance on the dollar. For Hong Kong, a financial gateway between East and West, this shift presents both opportunities and challenges. The city’s gold markets are well-positioned to facilitate trade settlements, as gold emerges as the de facto global currency for BRICS+. With members like Indonesia and potential joiners like Malaysia and Vietnam, the alliance’s growing influence underscores Asia’s pivotal role in the evolving monetary order.

Global Monetary Shifts

The U.S. dollar’s dominance is under pressure, and President Trump’s hints at a weaker dollar—while maintaining its reserve status—add complexity to the global financial landscape. The 1985 Plaza Accord, where the dollar was devalued by up to 50% yet retained its global crown, offers a historical precedent. However, walking this tightrope leaves little margin for error, especially as global central banks, including those in the U.S., rush to buy gold. In 2025 alone, up to 2,000 tons of gold have entered U.S. reserves, signaling a broader shift. Trump’s cryptic Truth Social post—“THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES”—suggests a strategic pivot toward precious metals. As the era of fiat currency dominance wanes, gold’s role is poised to grow, offering Asian investors a stable anchor in turbulent times.

The Everything Hedge

Gold’s value extends far beyond inflation hedging. Despite tame inflation in recent years (except for a 2022 surge), prices have soared, reflecting its role as an “everything hedge.” For Hong Kong investors, risks are multifaceted: U.S.-China trade tensions, potential tariffs, and regional geopolitical shifts like the Ukraine conflict all loom large. Add to this the uncertainty of global economic policies, such as potential U.S. tax reforms or the Department of Government Efficiency (DOGE) initiative, and the need for a safe-haven asset becomes clear. Gold’s stability offers a buffer against these uncertainties, making it a cornerstone of diversified portfolios in Asia’s financial hub.

Gold: A Time-Tested Protector, Not a Speculative Gamble

It’s important to note that gold is not a get-rich-quick scheme, unlike speculative assets such as cryptocurrencies or micro-cap stocks, which promise rapid gains but often deliver volatility and risk. Gold’s value lies in its reliability, honed over centuries—even millennia—as a protector of wealth. Inflation, the nemesis of financial stability, often stems from the endemic mismanagement of fiat (paper) currencies by governments and central banks. History is replete with examples of currencies debased through overprinting, from the Roman denarius to modern hyperinflation crises in places like Zimbabwe and Venezuela. Gold, by contrast, has endured as a universal store of value, immune to such mismanagement, offering Hong Kong investors a time-tested shield against the erosion of purchasing power.

Collectible Gold: Rare Coins and Limited-Edition Treasures

For those seeking higher returns, collectible gold offers an enticing avenue. Rare gold coins, such as pre-1933 U.S. Double Eagles or limited-edition releases from the Perth Mint, can appreciate far faster than the intrinsic gold price due to their numismatic value, driven by rarity, condition, and historical significance. Similarly, limited-edition gold collectibles—like the intricately crafted minifigure sculptures available at bullionbeasts.com—blend artistry with precious metal, appealing to both collectors and investors . These items can see substantial price surges, especially when demand outpaces supply, but caution is key. Overpaying is a risk unless you can verify the coin’s rarity through grading by trusted services like PCGS or NGC, or confirm the collectible’s limited production run. For Hong Kong’s discerning investors, this niche market adds a layer of excitement, provided due diligence is exercised.

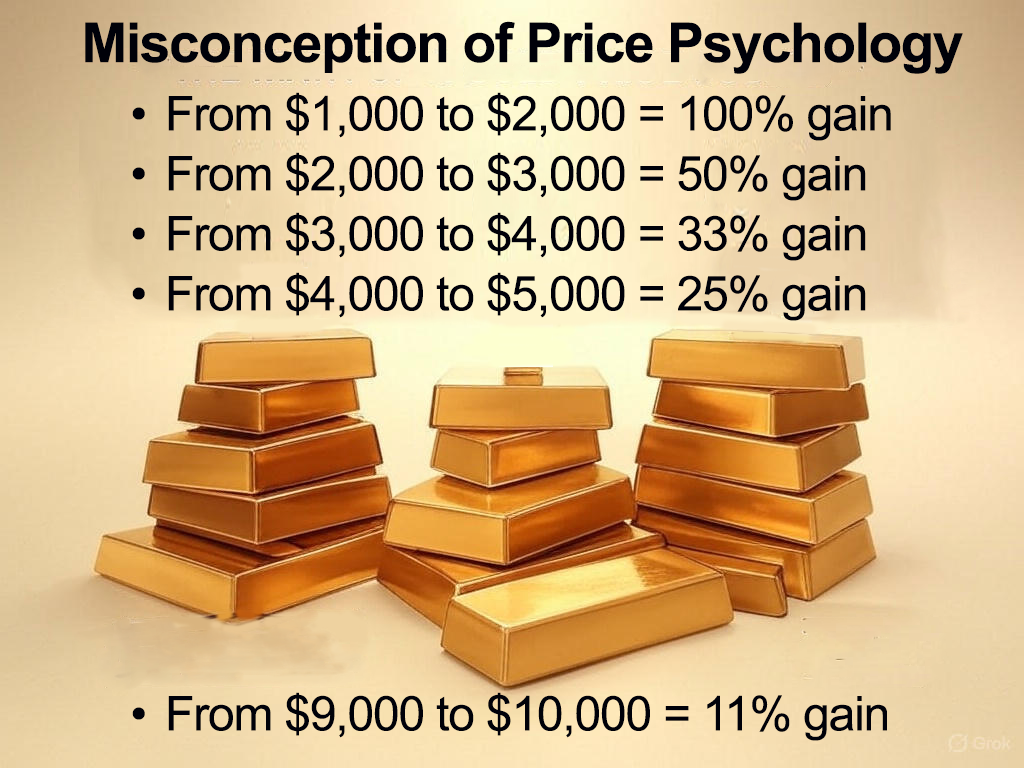

The Path to $10,000: Math and Psychology

Gold’s momentum could propel it to $10,000 per ounce, driven by a combination of simple math and investor psychology. Each $1,000 gain requires a smaller percentage increase as prices rise:

- From $1,000 to $2,000 = 100% gain

- From $2,000 to $3,000 = 50% gain

- From $3,000 to $4,000 = 33% gain

- From $4,000 to $5,000 = 25% gain

- ...

- From $9,000 to $10,000 = 11% gain

Investor psychology, or “anchoring,” leads individuals to treat each $1,000 gain as equal, yet the effort decreases with higher baselines. In Hong Kong and China, where retail demand is already robust—driven by cultural affinity and economic caution—a broader buying frenzy could accelerate this trend. Latecomers still have time to capitalize on potential gains, especially as global uncertainties fuel gold’s appeal.

Investing in Gold: A Hong Kong Perspective

Hong Kong investors enjoy unparalleled access to gold, thanks to the city’s robust markets and proximity to mainland China. Physical gold—preferred for its security—includes one-ounce coins like Canadian Maple Leafs or Australian Kangaroos, widely available through trusted local dealers. For larger investments, 1-kilo bars from refiners like Heraeus or PAMP Suisse are popular, often purchased during festive seasons as symbols of prosperity. Paper gold options, such as the SPDR Gold Shares (GLD) or Hong Kong-listed ETFs, offer price exposure but carry risks like contract terminations or counterparty failures, particularly during market disruptions.

Misconception of Price Psychology

Storage is a critical consideration. Avoid bank safe deposit boxes, which may be locked down in crises—a concern in Hong Kong given its history of political and economic turbulence. Instead, private vaults like those offered by Brinks or Malca-Amit in Hong Kong provide secure alternatives, often with insurance and 24/7 access. For smaller holdings, discreet home safes are a practical option, especially in a city where space is at a premium. A cultural practice in Asia—keeping gold holdings private—enhances security; as the saying goes, “wealth whispered is wealth preserved.”

The Future of Gold in Asia

As the global monetary order shifts, gold’s strategic importance grows. China’s aggressive gold buying, Hong Kong’s role as a trading hub, and the rapid accumulation of gold by global central banks signal a new era. The rise of CIPS, the yuan’s growing international role, and the BRICS+ payment system all point to a future where gold underpins financial stability. For Hong Kong investors, gold is not just a hedge but a gateway to preserving and growing wealth in an unpredictable world. With uncertainties mounting—from trade wars to currency devaluations—allocating a healthy portion of portfolios to gold, silver, and miners is a prudent strategy. The monetary chaos is just beginning, and precious metals are poised to be the primary beneficiaries.