Gold in 2025: Why It’s Still a Smart Bet

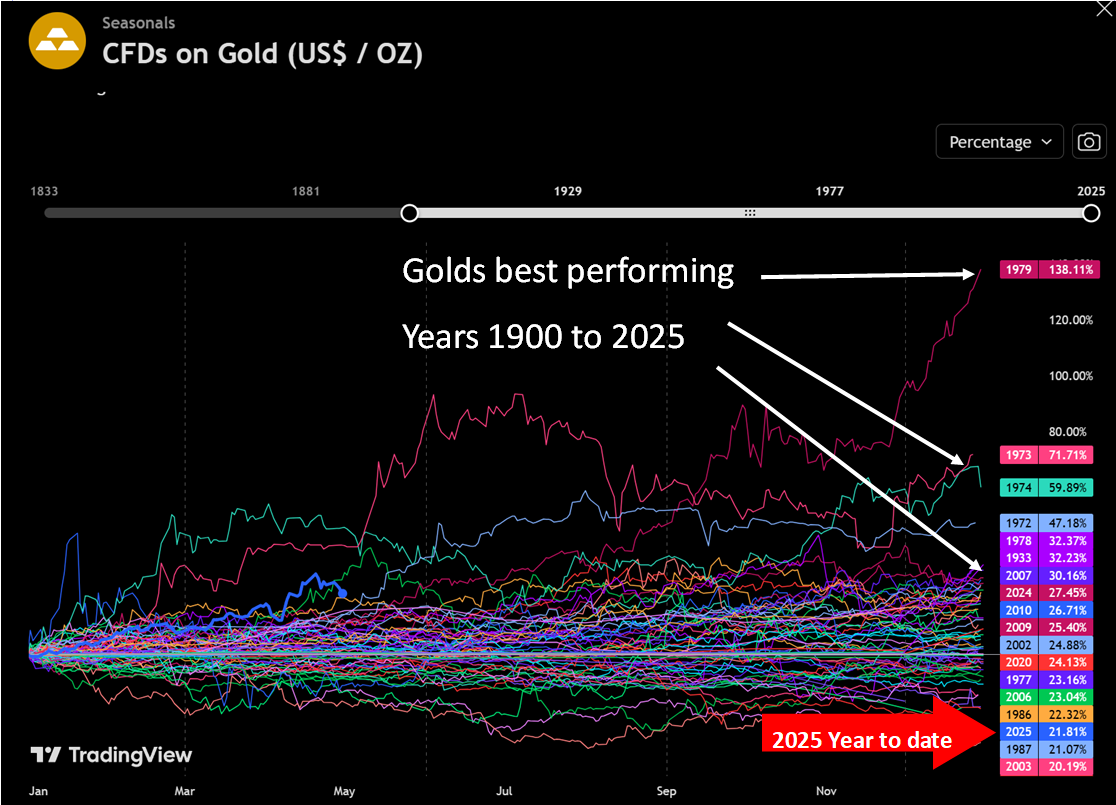

Gold’s having a fantastic year! As of May 01, 2025, it’s up over 21%, which is nothing to sneeze at. But here’s the kicker: even with that kind of run, it’s not even close to cracking the top 10 best years for gold in history.

If you think its can't possibly get any higher, take a look below at what happened back in 1979!

Chart: Historical yearly gold prices, years 1900 to 2025 to date. Source Bullion Beasts/Tradingview.

Yes, you read that right. 138% growth in gold prices in a single year!

History shows these wild gold years clumping together. It's exactly why it’s worth paying attention to right now.

The History Lesson: Gold’s Big Break After 1971

I’ve been digging into gold’s performance (pun intended), spanning over a century, and (with only one exception in 1933) all of its best years have occurred after 1971. That’s when Nixon pulled the plug on the gold standard, letting gold trade freely instead of being tied to the dollar. Suddenly, it could react to the world’s ups and downs. And boy, has it. Gold’s biggest wins tend to come when inflation’s running hot or the economy’s in a ditch. It’s like the metal was built for tough times.

As J.P. Morgan famously said around a century ago, “Gold is money. Everything else is credit.” That wisdom still rings true today, reminding us why gold remains a cornerstone of financial security.

Inflation: The Hidden Tax on Your Wealth

Politicians love to spin inflation as a sign of a healthy economy, but let’s call it what it is: a silent tax that erodes your purchasing power. Inflation means the money in your wallet buys less tomorrow than it does today—your groceries, rent, and gas all cost more, while your savings lose value. It’s toxic for the average person, who feels the pinch every time they swipe their card. Meanwhile, the wealthy and asset owners—those holding real estate, stocks, or gold—often come out ahead as their assets rise with inflation. This isn’t an accident; it’s a system that rewards those already at the top. Gold, unlike cash, holds its value over time, making it a shield against this insidious wealth transfer.

What’s Next for 2025? Likely A Breather, Then More Upside

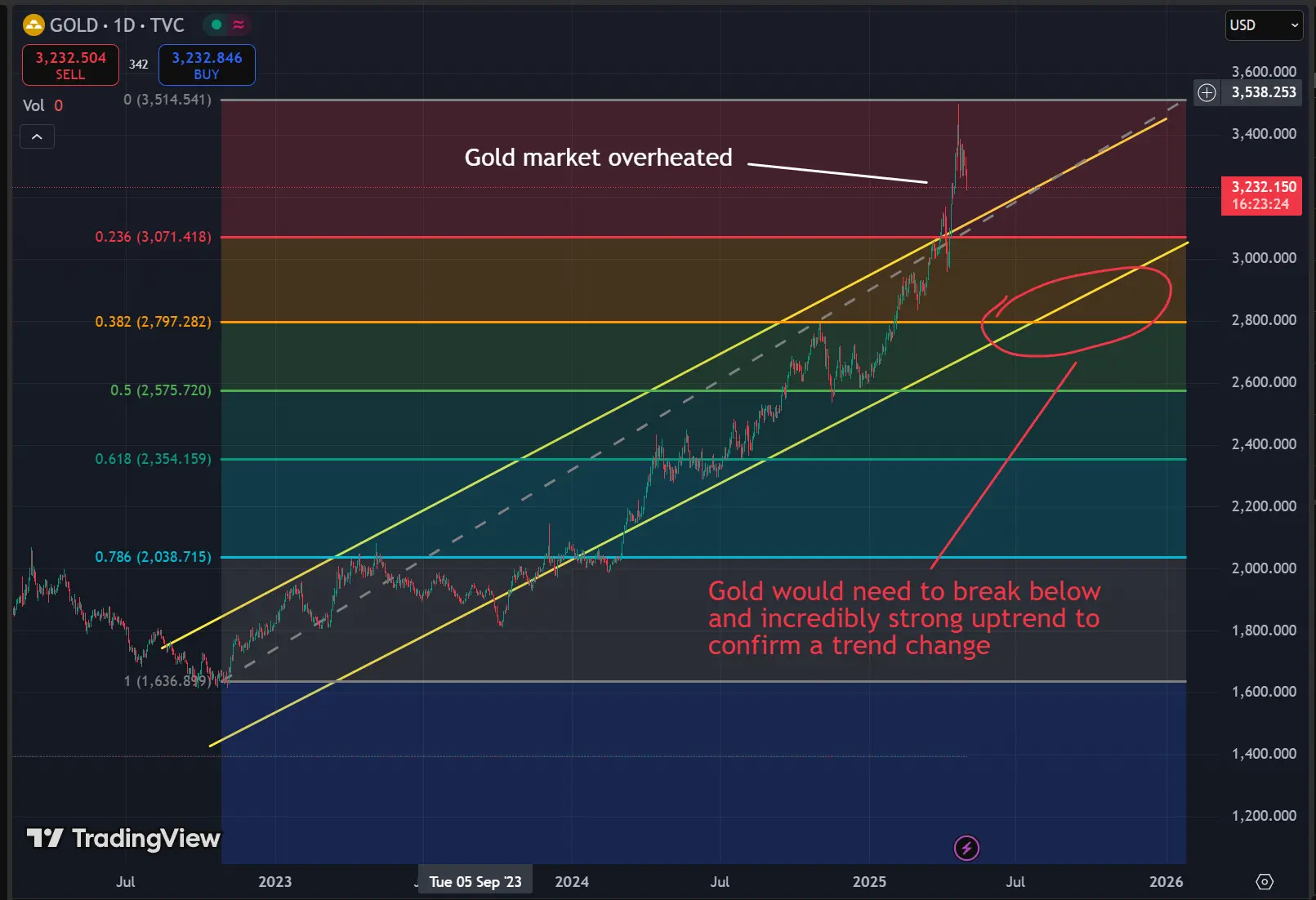

Gold’s been on a tear these first four months, no question. But when it moves this fast, it usually takes a pause to catch its breath. We might see some consolidation or even a dip in the coming months taking us back to the US $2800-3200 range.

If you take a step back and look at gold's rise since its last consolidation phase in 2023, you’ll see that gold has been in a very solid uptrend (shown in yellow below). Ignoring the recent parabolic move, gold would need to break meaningfully below USD 2,800 per ounce to disrupt this epic run.

Chart: shows the uptrend in gold price since 2023 marked by yellow bands, with highlights showing where price needs to fall to mark a change in trend. Source: Bullion Beasts/TradingView.

At Bullion Beasts, we’re not sweating it—those dips are just chances to buy in.

Our Crystal Ball Predictions For The Remainder of The Year!

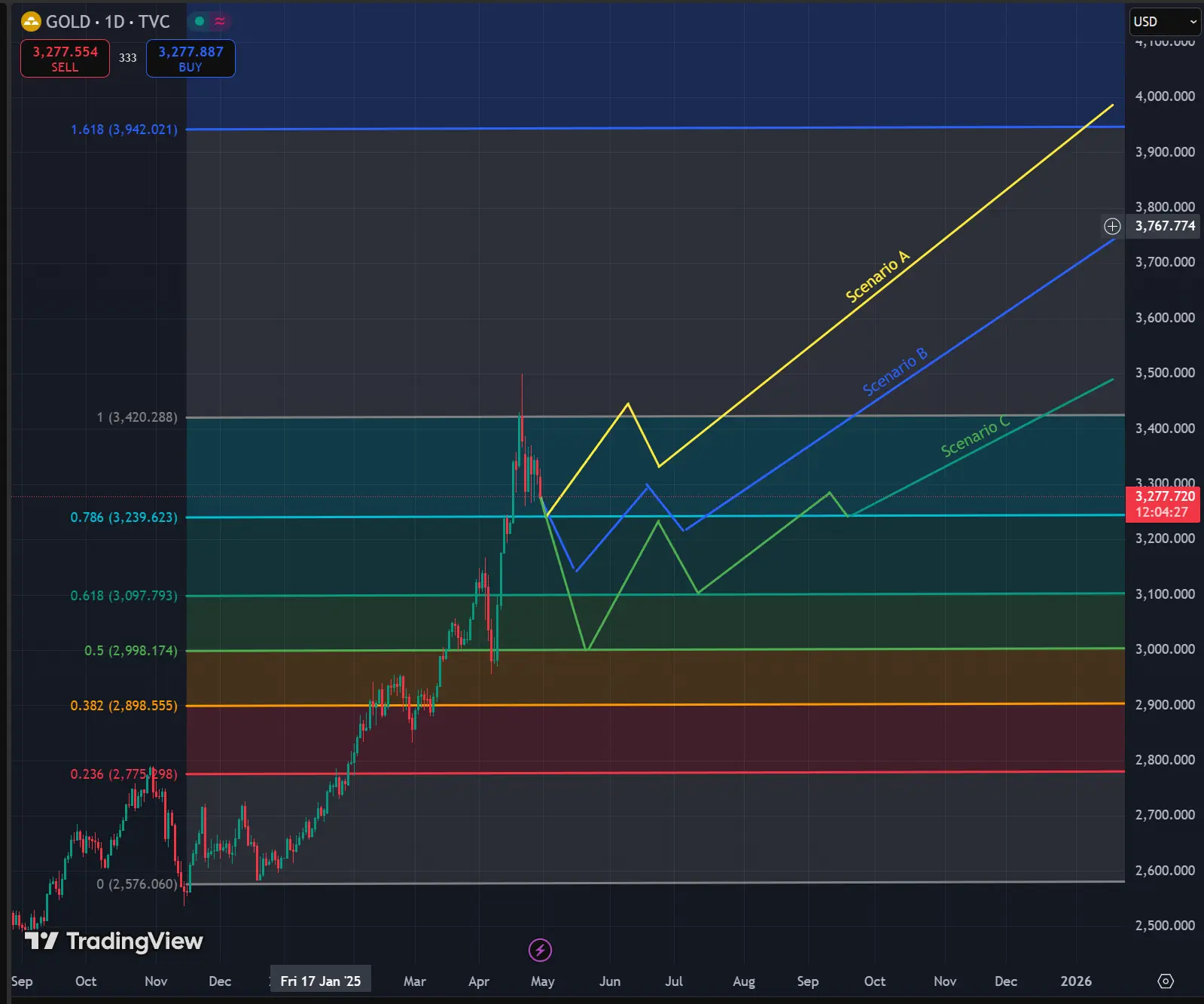

Predicting commodity prices—or even stocks—with certainty is inherently challenging, especially over longer time horizons, as no one has a crystal ball. That said, given the current global macro events, we maintain a strong long-term bullish outlook for gold, despite potential short-term volatility. Based on the three scenarios outlined below, we believe Scenarios B or C are the most likely, with gold holding above USD 3,000. Any move towards USD 2800 would need to be watched more closely.

Chart: Gold price predictions through 2026, showing three potential scenarios. Scenario A (yellow) and Scenario B (blue) suggest a strong upward trend, potentially reaching USD 3,767.774 or higher, while Scenario C (green) indicates a more conservative rise. Source: Bullion Beasts -TradingView.

As such, we are sticking to our call: gold’s heading north of $3,500 an ounce by the end of 2025. With inflation still lurking and global markets feeling shaky, the setup looks solid. If you’ve been sitting on the sidelines, now’s the time to get in the game.

Gold Isn’t Just About Profits—It’s About Protection

Here’s how I think about gold: it’s not just about making a quick buck. Sure, it’d be nice if it hits $4,000, but that’s not why I own it. I own gold because I worry about what happens if things really go south—say, gold shooting to $10,000 because the Dollar, Euro, Yen, or even the RMB collapses in the next big financial crisis. Gold’s like an insurance policy for your money, a shield against currencies losing their value. In a world where central banks keep printing cash, that’s no small thing.

The Bottom Line: Don’t Miss Out

Gold’s not in the record books yet for 2025, but it’s doing what it does best: holding strong when the world feels wobbly. If we get a pullback soon, don’t panic—use it to grab a position. At Bullion Beasts, we’re telling anyone who’ll listen: if you don’t own gold, you’re missing a key piece of the puzzle. It’s not just an investment; it’s peace of mind.

Keep shinning!

Bullion Beasts Team

About Bullion Beasts Bulletin

Stay ahead of the market with Bullion Beasts’ weekly newsletter—your essential guide to global macroeconomic events and the latest in precious metals. From gold price trends to expert insights on silver, platinum, and more, we deliver actionable updates straight to your inbox to help you make informed investment decisions. Sign up now and join a community of savvy collectors and investors!

Free Weekly Newsletter

Sign up for free, cancel any time

#bullionbeasts, #investingold, #gold, #bullion