Gold’s Ascent: Why I Believe It Will Reach $5,000 by the End of 2026

As we navigate the complex financial landscape of 2025, I am increasingly convinced that gold is poised for a dramatic surge, reaching $3,500 per ounce by the end of this year and climbing beyond $5,000 per ounce by the close of 2028. This bullish prediction is not rooted in speculation alone but is grounded in a confluence of economic trends, including persistent currency debasement, escalating global debt levels, and the looming possibility of central banks resorting to massive quantitative easing (QE). These factors, combined with gold’s historical role as a safe-haven asset, suggest a correction is inevitable—one that will drive investors toward gold as a bulwark against uncertainty.

The Foundation: Gold’s Historical Resilience and Current Momentum

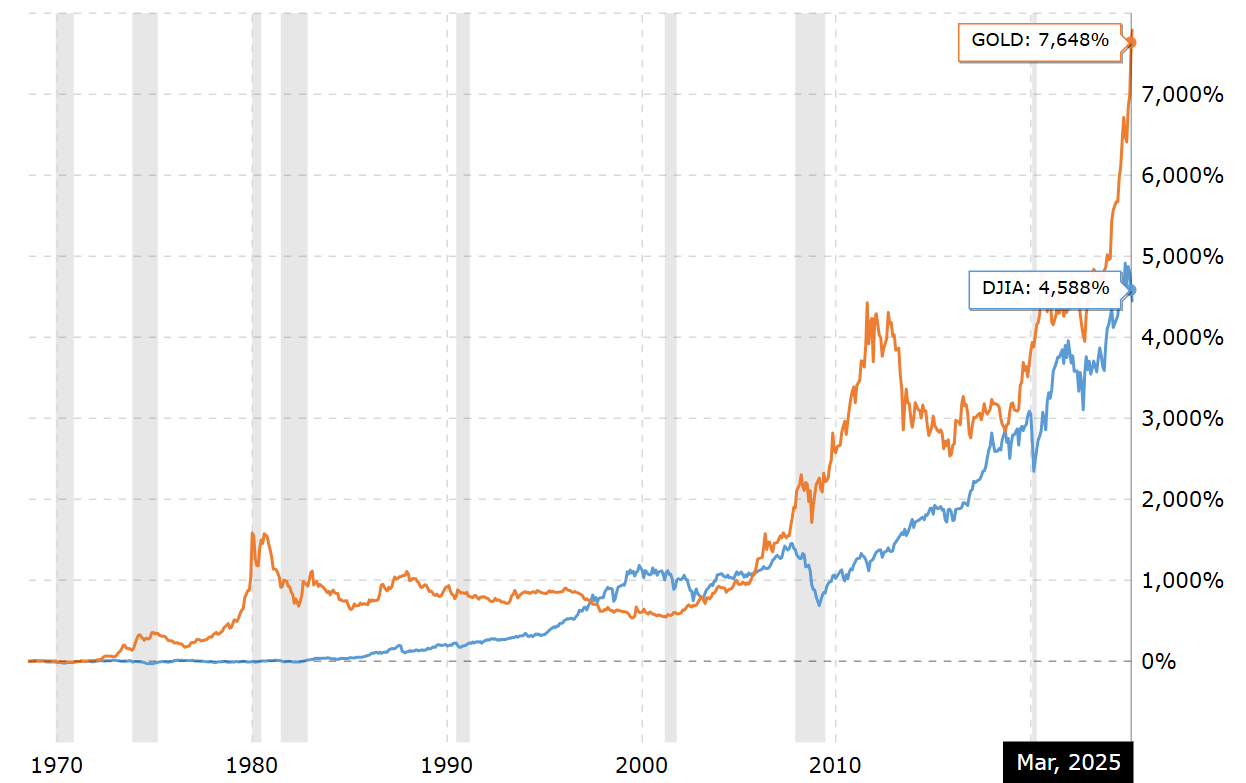

Gold has long been revered as a store of value, particularly during periods of economic turmoil. Its price trajectory in recent years underscores this role. In 2024, gold prices soared over 30%, reaching record highs above $2,700 per ounce, driven by geopolitical tensions, a weakening U.S. dollar, and robust demand from central banks, especially in emerging markets like China, Russia, and Turkey. With prices already hovering around $3,000 per ounce at the time of writing, the metal is already showing signs of sustained upward momentum. Analysts and institutions, including Goldman Sachs, J.P. Morgan, and Citi, have revised their forecasts upward, with many predicting gold could hit $3,000–$3,100 per ounce by the end of 2025. However, I believe these estimates are conservative, given the accelerating pressures on global financial systems.

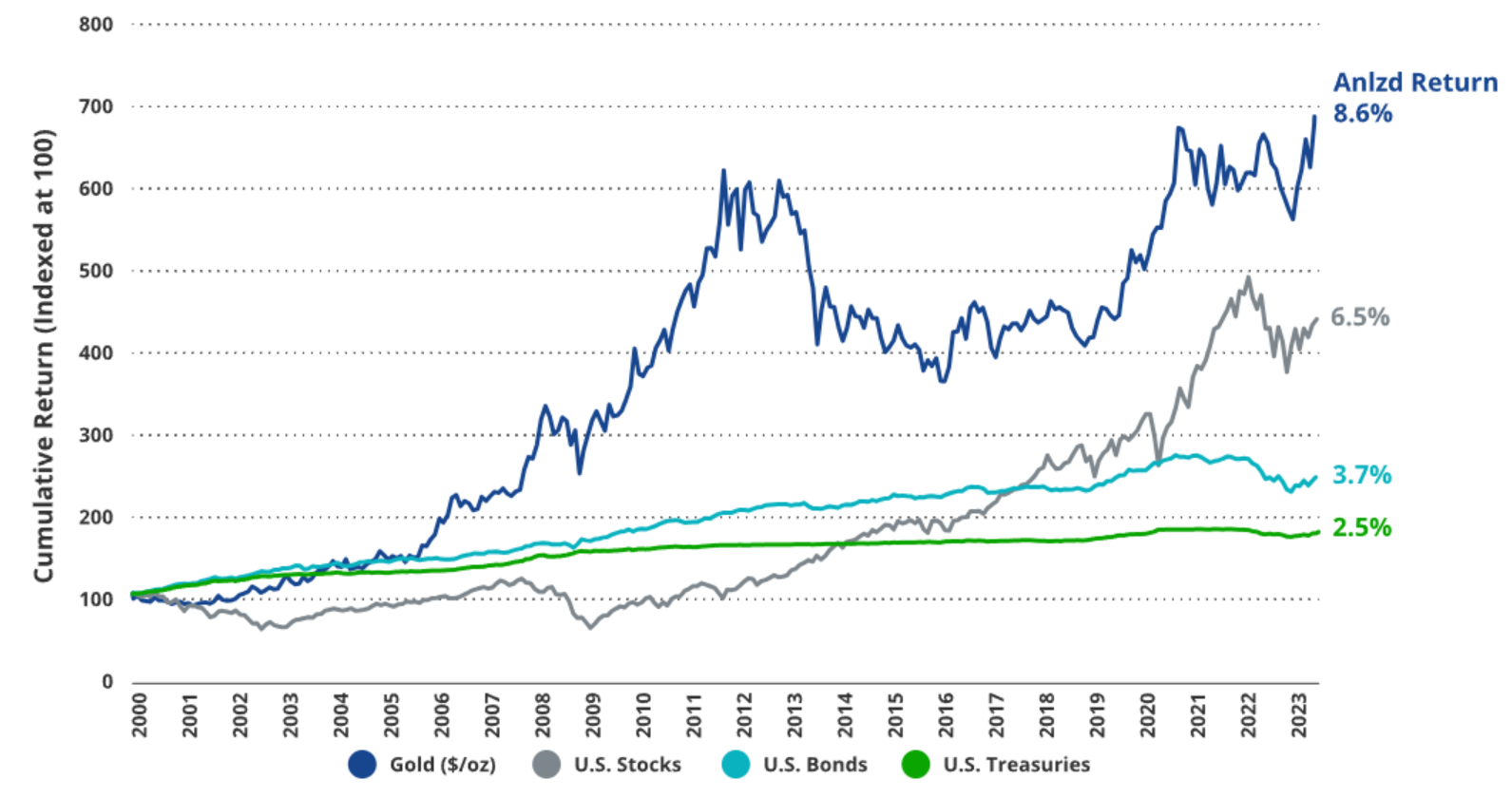

source: Vaneck

Of course, not all forecasts are bullish for gold. Some analysts, such as those at Traders Union, predict more conservative or even bearish scenarios, with gold potentially stabilizing around $2,000 per ounce if inflation eases and the U.S. dollar strengthens. A stronger dollar, driven by higher interest rates or economic stability, could temporarily suppress gold prices. However, I remain skeptical of these projections, given the structural challenges—currency debasement, global debt, and potential QE—that are unlikely to resolve quickly. Even if short-term pullbacks occur, gold’s long-term trajectory remains upward, supported by the fundamental drivers I’ve outlined

Currency Debasement: Eroding Trust in Fiat Currencies

One of the primary drivers behind my bullish gold forecast is the ongoing debasement of major currencies, particularly the U.S. dollar, which remains the world’s primary reserve currency. Since the end of the Bretton Woods system in 1971, when the dollar was decoupled from gold, its purchasing power has steadily eroded due to inflation, money printing, and monetary policy experiments. Over the past decade, the U.S. dollar has faced renewed pressure from inflation spikes—reaching levels not seen since the 1970s and early 1980s—coupled with de-dollarization efforts by nations like China, India, and members of the BRICS bloc. These countries are increasingly conducting trade in their own currencies, reducing reliance on the dollar and, in turn, intensifying fears of its long-term stability.

This debasement is not limited to the U.S. dollar. Other major currencies, such as the Pound, Euro and Yen, have also been subject to inflationary pressures and monetary easing, further undermining confidence in fiat systems. Gold, as a tangible asset immune to the whims of central bank policies, stands to benefit as investors seek to preserve wealth. Historical patterns, such as the gold price surge to $850 per ounce in 1980 amid high inflation and geopolitical unrest, or its climb above $2,000 per ounce during the COVID-19 pandemic, reinforce this trend. With inflation expectations remaining elevated—driven by central banks targeting a 2% annual CPI, which often underestimates real-world price increases.

Global Debt Levels: A Ticking Time Bomb

Another critical factor is the alarming rise in global debt levels, which reached approximately $315 trillion by the end of 2024, according to various economic reports. In the United States alone, sovereign debt stands at around $36 trillion, or roughly 124% of GDP, a figure that continues to climb amid persistent budget deficits and political gridlock. This debt burden is not unique to the U.S.; many developed and emerging economies, including Japan, China, and the European Union, are grappling with similarly unsustainable debt-to-GDP ratios.

This escalating debt creates a precarious situation. Governments and corporations are increasingly reliant on borrowing, often at low interest rates facilitated by central bank policies. However, as interest rates rise or economic growth stalls, the cost of servicing this debt becomes unsustainable, potentially triggering a financial correction. Gold, historically uncorrelated with debt-laden assets like stocks and bonds, becomes an attractive refuge during such crises. The 2008 financial crisis, when gold prices rose over 50% in nine months to hit $1,011 per ounce, and the pandemic-induced rally in 2020, are stark reminders of this dynamic. As global debt levels strain financial systems, I expect investor flight to gold to accelerate, driving prices past $5,000 per ounce by the end of 2026.

Quantitative Easing: Central Banks’ Last Resort

The interplay between currency debasement, global debt, and gold prices is likely to culminate in a scenario where central banks, particularly the U.S. Federal Reserve, resort to massive quantitative easing. QE, which involves injecting money into the economy by purchasing government bonds and other securities, has been a go-to tool for central banks since the 2008 crisis and during the COVID-19 pandemic. While the Fed has paused QE in recent years to combat inflation, the current economic environment—marked by high debt, potential recession risks, and geopolitical instability—could force a reversal.

If a correction occurs, as I anticipate before the end of 2027, central banks may unleash unprecedented levels of QE to stabilize markets, lower borrowing costs, and prop up faltering economies. This would likely lead to further currency debasement and inflation, both of which are bullish for gold. Historical data shows a strong correlation between QE and gold prices: during the Fed’s QE programs post-2008 and in 2020, gold prices surged as the money supply expanded. Analysts predict that central banks’ continued gold purchases—averaging around 50–70 tonnes per month, as noted by Goldman Sachs—will further support this trend. If QE resumes on a massive scale, I believe gold could easily surpass $3,800 per ounce by the end of 2025 and climb to over $5,000 by 2026, as investors seek protection against a devalued dollar and rising prices.

Geopolitical Tensions and Safe-Haven Demand

Beyond economic factors, geopolitical tensions are amplifying gold’s appeal as a safe-haven asset. Ongoing conflicts in the Middle East, Eastern Europe, and potential flashpoints like Taiwan continue to unsettle markets. These uncertainties drive investors toward assets perceived as stable and reliable, with gold at the forefront. Central banks, particularly in emerging markets, are diversifying away from the U.S. dollar and increasing gold reserves to mitigate risks from financial sanctions and currency fluctuations. The World Gold Council’s 2024 survey indicated that nearly 60% of advanced economy central banks expect gold’s share of global reserves to grow over the next five years, a trend that will sustain demand and push prices higher.

A Golden Opportunity

In summary, I am confident that gold will continue to rise driven by a perfect storm of currency debasement, escalating global debt levels, and the likelihood of central banks implementing massive quantitative easing. These factors, combined with gold’s historical role as a safe-haven asset and robust demand from investors and central banks, create a compelling case for its ascent.

While challenges like a stronger dollar or temporary market corrections may arise, the underlying economic and geopolitical pressures will ultimately propel gold to new heights. For investors, this presents a golden opportunity to protect wealth and capitalize on one of the most significant bull markets in recent memory. As we move through 2025 and into 2026, keeping a close eye on inflation, debt levels, and central bank policies will be crucial to understanding gold’s trajectory—and seizing the moment.

No one has a crystal ball. Maybe this time it will in fact be different and gold will finally be retired as a store of wealth. However judging by over 3000 years of recorded economic history, every previous experiment in fiat (paper money backed by promises alone) has ended badly. I don't expect this time to be any different.

source: bullionbeasts.com

By Jamie Turnough

CEO Bullion Beasts

About Bullion Beasts Bulletin

Stay ahead of the market with Bullion Beasts’ weekly newsletter—your essential guide to global macroeconomic events and the latest in precious metals. From gold price trends to expert insights on silver, platinum, and more, we deliver actionable updates straight to your inbox to help you make informed investment decisions. Sign up now and join a community of savvy collectors and investors!

Free Weekly Newsletter

Sign up for free, cancel any time

#bullionbeasts, #investingold, #gold, #bullion